Is the Corn Market Undervalued?

Corn, in a number of its various forms, remains my market of choice when it comes to long-term investments.

Recently the discussion has turned to if the corn market(s) are undervalued meaning a potential buying opportunity.

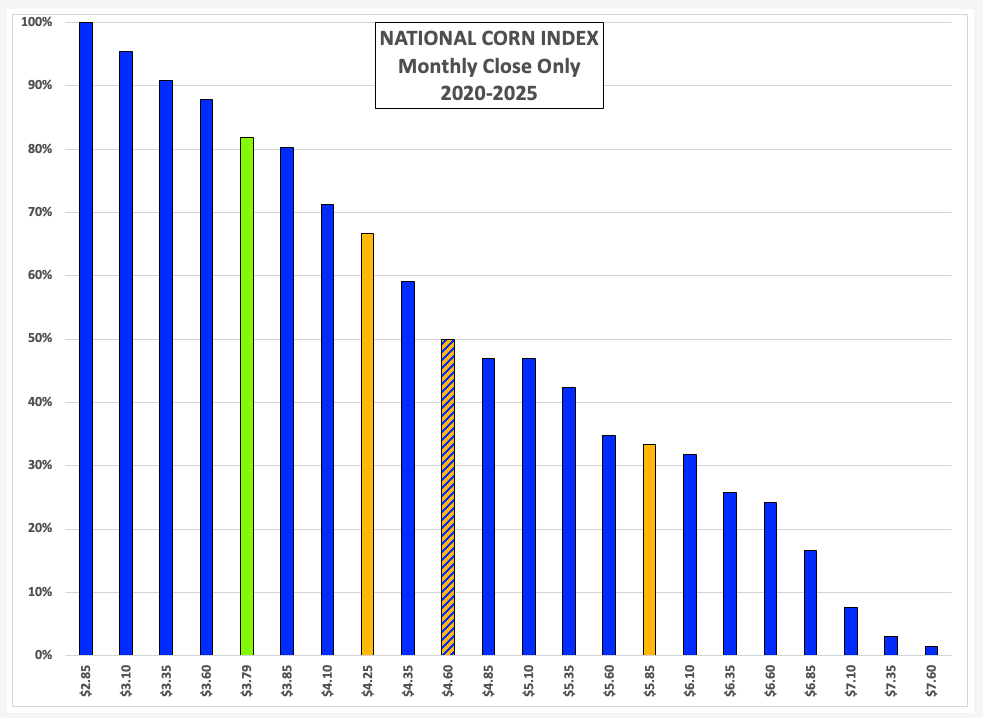

Fundamentally, the National Corn Index has fallen into the lower 20% of its price distribution range, providing us different types of investment information.

As I’ve discussed numerous times, my market of choice when it comes to long-term investments is Corn. Why? The three key reasons are:

- Based on Peter Lynch’s advice to invest in what you know. Since moving to the US Corn Belt more than 20 years ago, I’ve spent more time analyzing and writing about the corn market than any other.

- It makes sense. Regardless of what type of analysis we put it through – technical, fundamental, algorithm – the corn market usually makes sense. Yes, I have to say usually because as the Vodka Vacuity tells us, there are no Absolutes in markets. Still, King Corn tends to follow its fundamentals, trends, seasonality, price distribution, etc. as well as any other market I’ve looked at.

- It isn’t nuts. Again, usually. Just as some traders prefer bonds over equities, I like corn more than soybeans, wheat, cattle, and the rest of the commodity complex. While volatility can and will rise and fall, this provides opportunity rather than ulcers, as is the case in the wheat sub-sector, natural gas, and others.

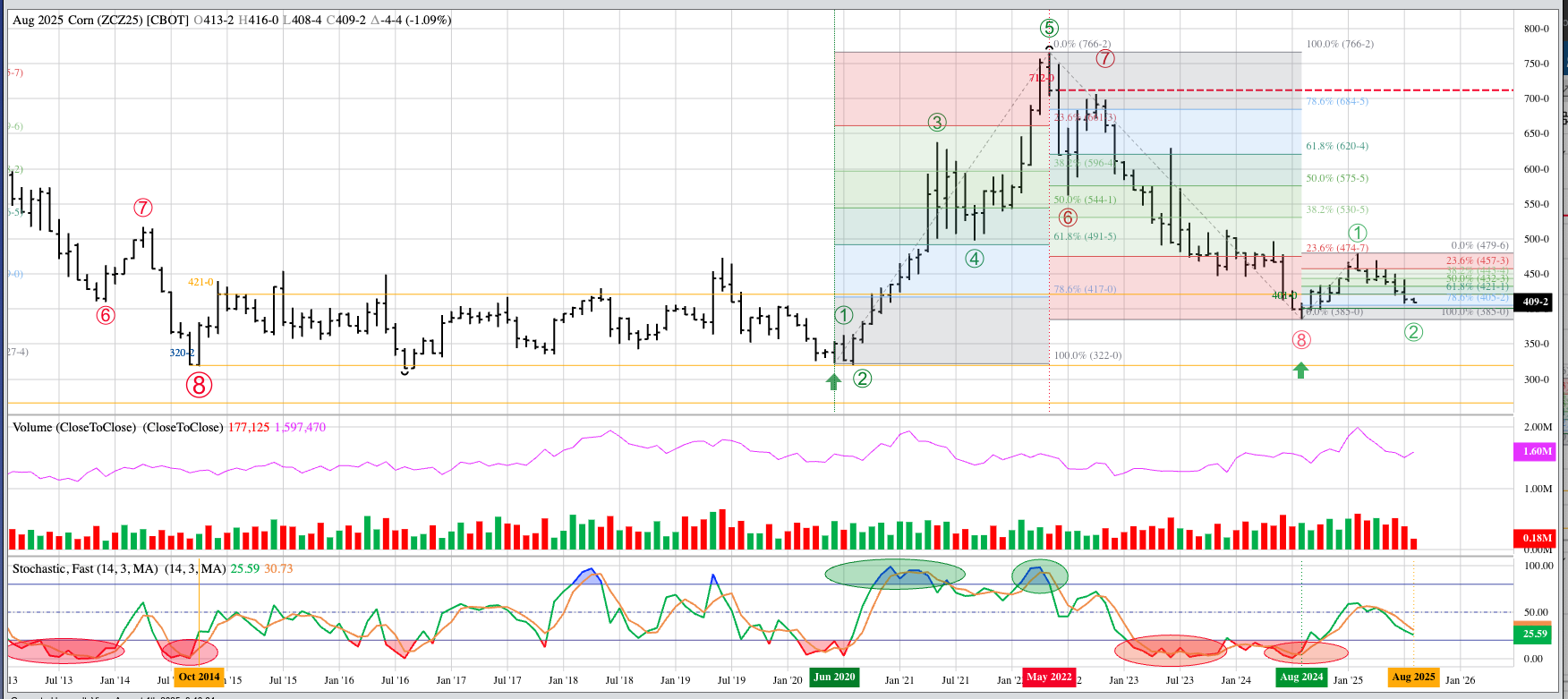

In my previous piece for Barchart I talked about the long-term position in the Teucrium CORN ETF (CORN). However, if I’m a long-term investor interested in the futures market, I’d have a position in a December corn futures contract-only fund. As July ended, this fund would’ve resembled a contortionist, in a number of theoretical positions, some of them looking uncomfortable. To recap:

- Short Dec25 (ZCZ25) near $4.80

- Short Dec25 at $4.60

- 40 cents added through a series of short option positions

- Before 20 cents were used to buy Dec25 $4.20 calls (July 16) (ZCZ5|420C)

- Long Dec26 (ZCZ26) near $4.60

- Still based on the bullish technical reversal pattern at the end of August 2024

- Ending the long-term downtrend that began at the close of May 2022 with Dec22 priced at $7.1150.

As we get rolling in August 2025, the corn market remains under pressure. Overnight through early Monday morning (August 4) saw Dec25 dip to a low of $4.0850, 1.0 cent off its new contract low posted in mid-July and still above the August 2024 mark on the continuous monthly chart of $3.8550. Recently, I’ve heard the discussion of the corn market being undervalued meaning it could soon find renewed buying interest from both commercial and noncommercial (fund, speculative, investment, etc.) traders. To add to this debate, let’s look at corn’s intrinsic value – the National Corn Index.

Based on the theme of the Grass is Greener Movement (Investment money moves into commodities when REAL fundamentals turn increasingly bullish), what do we know about the corn market’s real fundamentals?

- Deferred futures spreads – March-May and May-July – have stabilized in neutral territory indicating commercial uncertainty regarding long-term supply and demand.

- National average basis is neutral-to-bearish.

- Calculated last Friday at 38.25 cents under Dec25 futures, as compared to the previous 5-year low weekly close and 10-year average weekly close for the first week of September at 30.0 cents under December.

- At the end of July, the National Corn Index was priced at $3.7850, putting it in the lower 18% of its price distribution range based on monthly closes-only dating back through January 2020.

From an investment point of view, there are a couple ways to look at the price distribution study:

- Based on the idea that a market in the lower 33% of its range could be considered undervalued, long-term investors could view the intrinsic price of the corn market as undervalued. Given noncommercial traders recently held a net-short futures position of 155,500 contracts (Tuesday, July 1), the corn market could find support from noncommercial short-covering. The most recent CFTC Commitments of Traders report (legacy, futures only) showed this position had been trimmed to 133,500 contracts as of Tuesday, July 29.

- On the other hand, if we apply the economic Law of Supply and Demand we know the low price of the Index is telling us supplies of US corn available are gaining on quantities demanded. Given fundamentals win in the end, (Newsom’s Market Rule #6), until we see a shift in the intrinsic value of the market the investment side can stay comfortable being bearish.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.