Is the Corn Market a Buy?

The general consensus at the recent Barchart meetings I had the opportunity to take part in was that the corn market seemed ready to turn.

This makes sense if we apply technical, seasonal, and price distribution analysis to our long-term investment positions.

The question comes to fundamentals, where the market is not, nor has it been, as bearish as USDA's latest round of guesses.

As you know, when it comes to long-term investments, my go-to market is Corn. When dealing with the futures market, I prefer to track the more heavily traded December contract (ZCZ25) only, rolling positions forward and back based on the long-time investor favorite Dec-Dec corn futures spread. As I talked about in late July, I had the opportunity to take part in Barchart’s Grain Merchandising and Technology meeting in Ames, Iowa and Manhattan, Kansas. The consistent theme in both discussions, with Thomas Call of Mid-Co Commodities and Guy Allen of Kansas State University, was that Dec25 corn was drawing near to a bullish turning point.

I agreed at the time and do even more so given Dec25 has posted new contract lows the past two weeks. That would seem bearish, based on both the economic law of Supply and Demand and the idea that bullish markets don’t make new lows. However, if we apply my Market Rules to December corn futures, what answer do we come up with to the question of the day: Is the Corn Market a Buy?

Market Rule #1: Don’t get crossways with the trend.

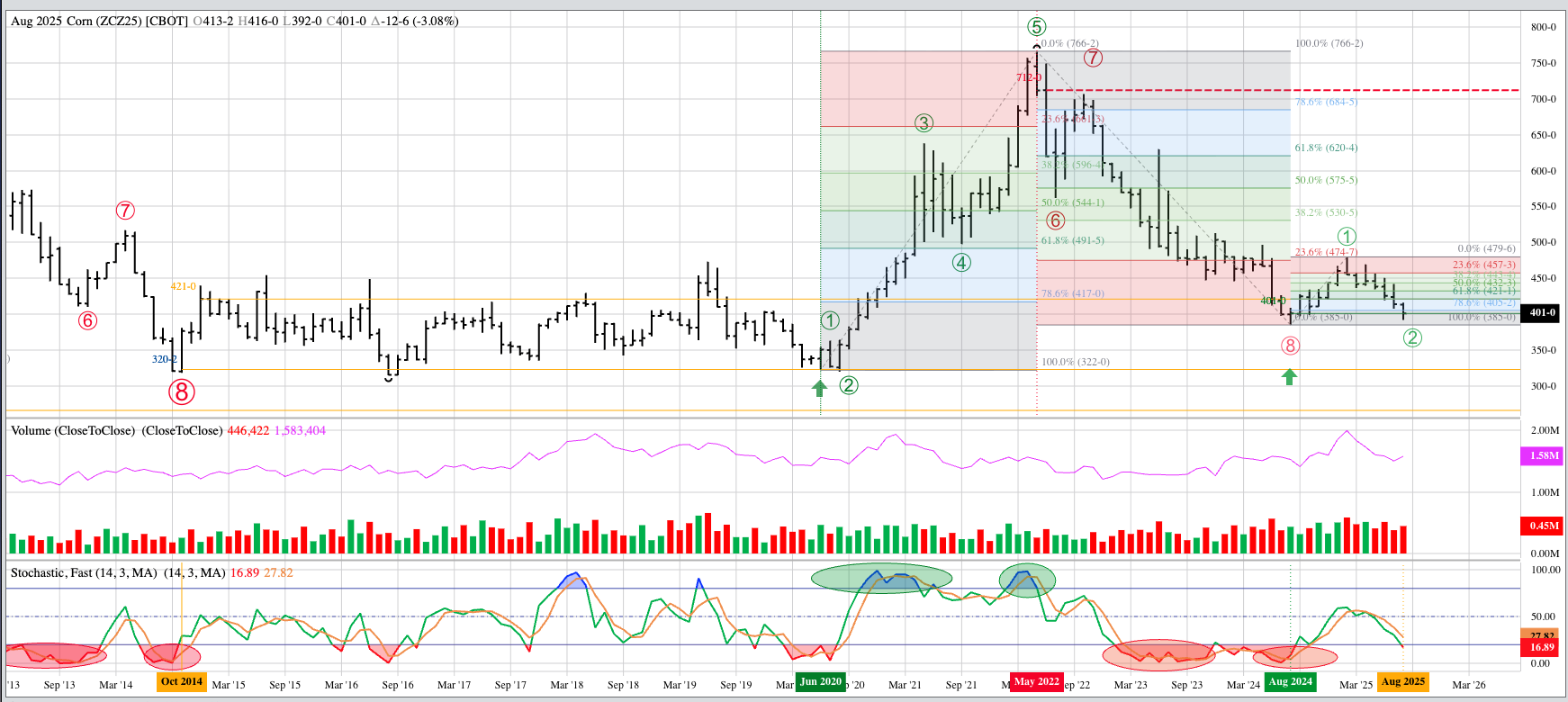

- The last few years have been an interesting ride after the Dec22 issue completed a bearish spike reversal[i] during May 2022, telling us the major (long-term) trend had turned down. This downtrend was in place until a year ago when the Dec24 issue completed a bullish spike reversal, leading to a Wave 1 rally peaking this past February and the ongoing Wave 2 selloff[ii].

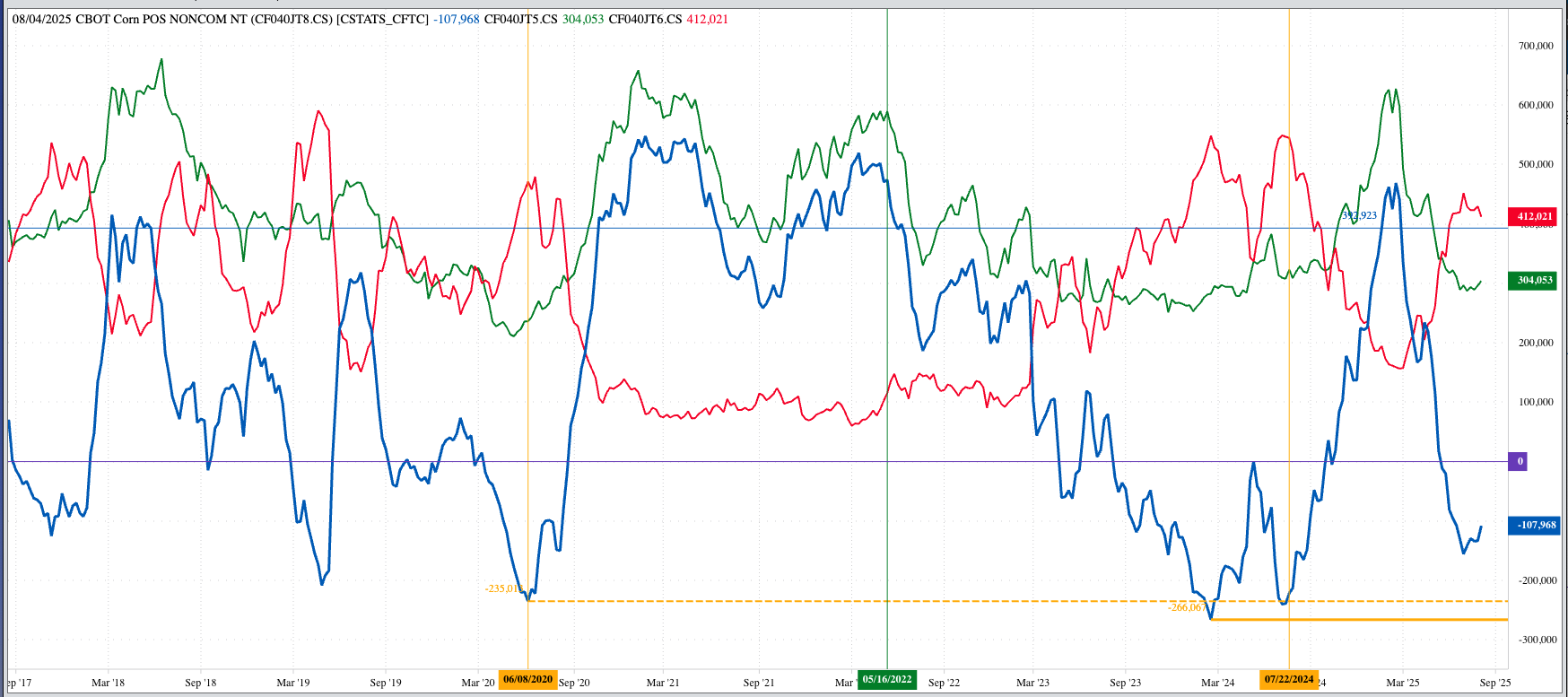

- As usual, at least from my point of view, the long-term trend has been driven by noncommercial activity. A look at the chart for the noncommercial futures-only position as reported weekly by the CFTC and we see funds started seriously liquidating long futures in mid-to-late May 2022 while adding short futures. The net-short futures position bottomed out at 266,067 contracts the week of February 20, 2024. By the time we reached late July 2024, Watson began covering its short futures positions.

- Approaching late August 2024, and we see the noncommercial net-short futures position is being trimmed again, a result of both short covering and new buying interest. All while Dec25 has held the August 2024 of $3.85 posted by Dec24, as is characteristic of Wave 2.

Market Rule #2: Let the market dictate your actions.

- With all the hullabaloo surrounding USDA’s ridiculous August supply and demand numbers, as well as the upcoming clueless Midwest crop tour, one would think corn fundamentals are tanking.

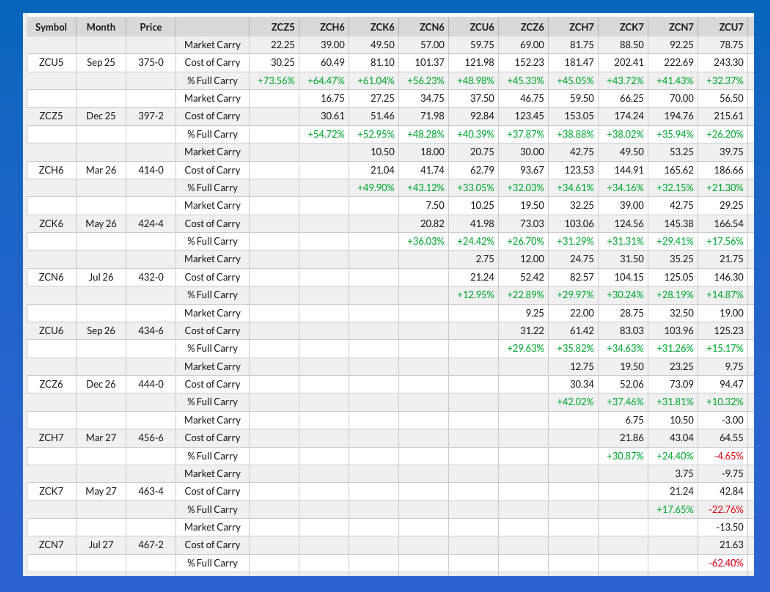

- A funny thing about that, though, as our reads on REAL SUPPLY AND DEMAND, most notably new crop futures spreads, have stabilized of late. The Dec-March spread increased its coverage of calculated full commercial carry to 57% through the end of July – about the time I was attending the Barchart programs – but then stabilized through mid-August. At the close of Thursday, August 14, the Dec-March futures spread covered roughly 55% while the Dec-July spread (the 2025-2026 market as a whole) was covering 48%. These are neutral reads rather than bearish.

Market Rule #6: Fundamentals win in the end.

- If I can see the 2025-2026 corn market is not fundamentally bearish, so can Watson. Given this, it would make sense for funds to cover short futures positions over the coming weeks.

- And if Watson is covering short futures, or buying, and funds set the trend of a market, as I’ve argued for decades, then the logical conclusion is the trend should remain up.

Market Rule #3: Use filters to manage risk. (The filters I use are Seasonal and Price Distribution Analysis, along with market volatility.)

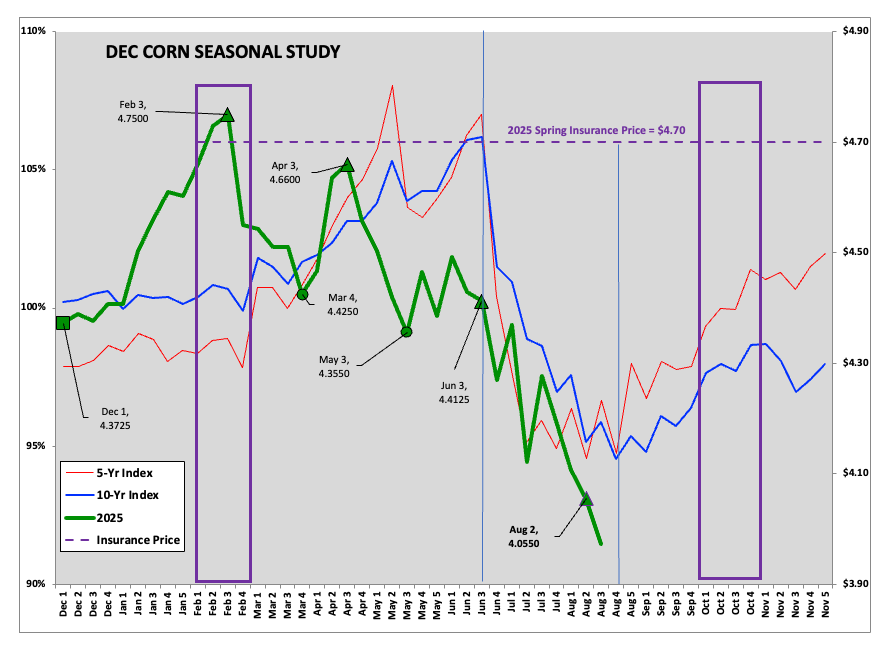

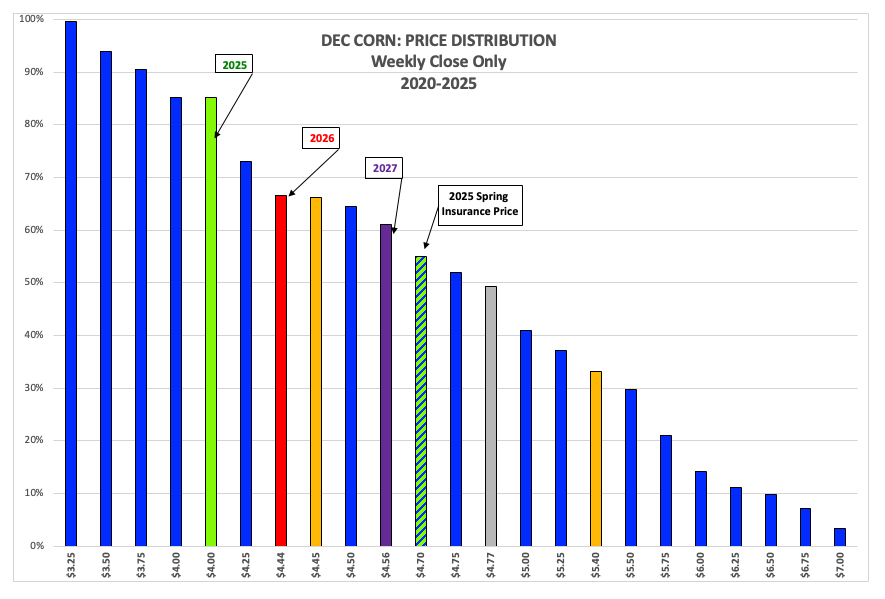

- Seasonally, December corn futures tend to post a low weekly close the fourth week of August. This after falling roughly 12% from the normal high weekly close the third week of June. Dec25 is priced near $4.00 early Friday morning (August 15), a drop of 16% from its high weekly close of $4.75 posted the third week of February. The bottom line is Dec25 has fulfilled both the time and space components of its normal seasonal tendencies.

- As for price, Dec25 sitting near $4.00 puts it in the lower 15% of its distribution range based on weekly closes only back through the 2020 contract. Using classic Price Distribution analysis, this tells us the contract doesn’t spend much time at or below this price level. Given funds are already short futures and producers aren’t in a hurry to sell, there is little incentive for Watson to continue to add put pressure on the market. This could lead to a round of short-covering as funds move money to markets with better return opportunities.

[i] A bearish spike reversal pattern is when the contract extends its previous uptrend before closing lower for the timeframe being studied.

[ii] Part of an Elliott Wave 5-wave uptrend pattern.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.